Methods to circumvent this regulation resulted in the proliferation of funnel accounts. In August 2013, a group of California residents were indicted for a drug trafficking conspiracy after trafficking prescription drugs across state lines. Accounts were set up specifically to funnel funds back to California in amounts under $10,000. The group deposited over $3.3 million and withdrew almost $3.1 million from these accounts in a structuring scheme that has emerged in Mexico-related criminal organizations.

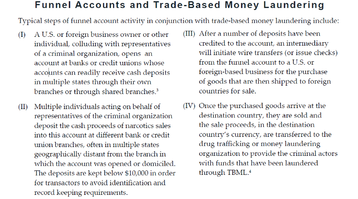

Funnel accounts are typically set up in multinational or nationwide banks and utilized because of the ease of access to cash deposits. Not only is a cash deposit typically available on an account immediately after the depository transaction, but also the funds are available anywhere that the account can be accessed: funds deposited in New York City are immediately available in Phoenix, Arizona or Santa Fe, New Mexico. Additionally, these accounts can be viewed and managed online, allowing for simple and quick communication of which accounts to utilize and how much to deposit or withdraw. From there, we see typical trade-based money laundering (TBML).

Source: FinCEN Guidance FIN-2014-A005

The Guidance also describes funnel account and TBML red flags. Find them here.